Here’s something that doesn’t happen every day: an Israel-based fintech company was instrumental in providing $40 million in growth capital to a Saudi Arabian business.

The fintech company, Liquidity Group – a multibillion-dollar global capital market credit automation company and fund manager — uses proprietary artificial intelligence technology to perform due diligence within 72 hours vs. an industry norm of six to 12 weeks.

TruKKer is the first technology-enabled truck aggregator in the Middle East and Asia, offering an Uber-like service for trucks, including automated booking, real-time tracking and monitoring.

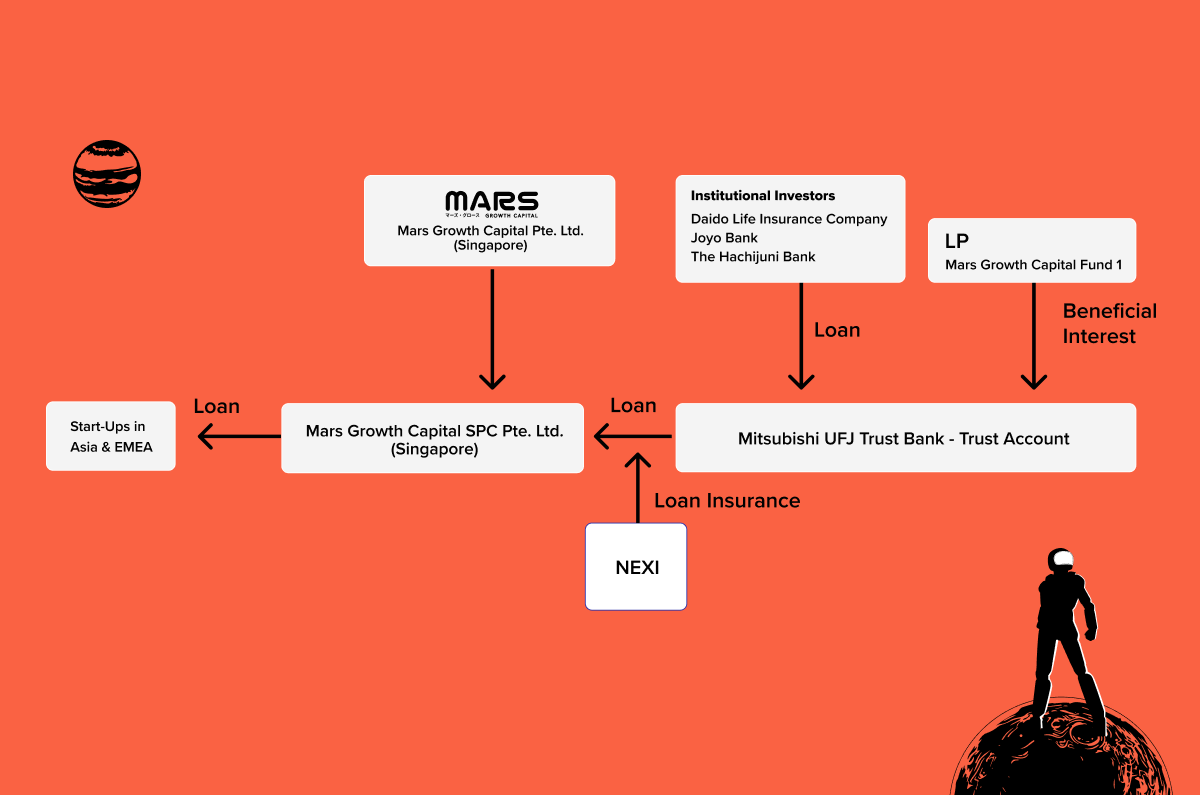

The $40 million was provided by Mars Growth, a joint venture of Liquidity Group and Japan-based Mitsubishi UFJ Financial Group (MUFG), the world’s largest non-state-owned bank.

MUFG and Liquidity have two joint venture funds that rely on Liquidity’s AI technology with a total MUFG investment of $500 million.

“From start to finish, the process was fast and easy,” said TruKKer founder and CEO Gaurav Biswas. “The non-dilutive funding will help us seize the opportunity to drive further growth in this sector with groundbreaking digitization and technology.”

Over the past two years, Liquidity Group has used its technology to grow an initial $70 million fund to more than $1.5 billion.

“TruKKer is transforming the vertical with its digital freight network,” said Liquidity Group cofounder and CEO Ron Daniel.

“Its exponential growth demonstrates the market’s appetite for the region’s first technology-enabled truck management system. We’re pleased to provide financing for their continued expansion.”

Perhaps this is a harbinger of continued positive change among Israel and its Gulf State neighbors.